Mark Langley-Sowter, Director at New Eden, discusses the paradigm shift that is occurring in the insurance industry as a result of Behavioural Analytics. Consequently, the focus in the claim process has shifted from ‘protecting, reacting to and then reviewing’ to ‘predicting, preventing and then protecting’.

Image used with permission from Formotiv

A paradigm shift is occurring in insurance where its basic premise is being turned on its head by new players. One of the key drivers and innovations pushing the technological boundaries that are changing the way insurers underwrite risks is Behavioural Analytics and Intelligence, or ‘Behaviour-as-a-Service’, as some insuretechs call it.

What can the AI track?

We are all well-aware of web-based Behavioural Analytics version 1.0, and ‘Google Analytics’ was a first example that recorded what we did when visiting a website – what we clicked, downloaded, how long we stayed, what we bought. We’re used to this tracking. However, using retail as a starting point, up to 84% of consumers still abandon purchases1 no matter how many items they put in their ‘basket’.

Retailers never understood why. Was there too much ‘friction’ completing forms (23% abandon at the ‘registration’ stage2), or payment details? Were adverts distracting? What else was going on? Thus, using advanced AI and Machine Learning techniques, Behavioural Analytics V2.0 is now an emerging platform which scrutinises how we behave when navigating a web page. Scrutinising how we complete an insurance form, submit payment details etc, to such a degree that certain insurers are starting to detect potential for increased risk and fraud.

How is information tracked?

They do this by detecting how long we take on a particular question, where we started, how many times we corrected certain fields or specific questions, if we swapped ‘yes’ for ‘no’, whether we used ‘copy & paste’ to fill in sensitive data. Up to 5000 data points can currently be mapped to produce a live picture of our ‘Digital Body Language’. Add this data to Voice Pattern Recognition responses already used to assess the validity of a claim, and the results are a Polygraph Test of increasing accuracy. As such, we at New Eden are combining this with our Cultural Analytics data.

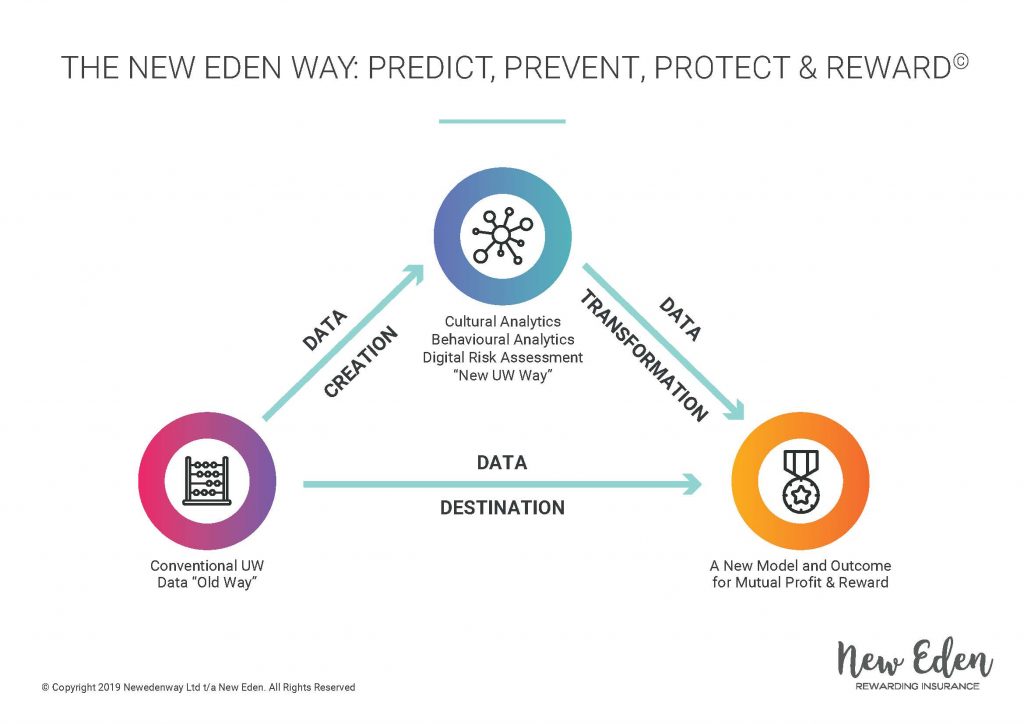

Therefore, the focus in insurance is changing from ‘protecting, reacting to and then reviewing’ a claim, to ‘predicting, preventing and then protecting’ (see Fig.1 below). This is a fundamental transformation with the emphasis on prevention, not cure and also has major implications for the role of brokers.

For in-person client interviews, combined body language, face and voice patter software is not far off. In the meantime, beware how you fill in your next PII renewal application!

Figure 1

Mark Langley-Sowter | Director | New Eden

Read more articles from Modern Insurance Magazine here