Capturing the New SMB Insurance Buyer by Meeting a New Risk Environment

A family-owned printing and mailing house is suffering through some daunting challenges. Paper is in short supply. Like many industries, supply chains have been inconsistent since the start of the pandemic. When the paper is available, they don’t have enough people to work at capacity on their folding, binding and packing equipment. They can’t afford to give new employees the common period of supervised training. Most of the equipment is dangerous. They are now at a higher risk for expensive production errors and costly production injuries.

Safety is a growing casualty of the current economy and labour shortages. In the next 10 years, 22% of skilled manufacturing personnel will retire.1 Healthcare workers are already in short supply. There are too few truck drivers, airline pilots, food service, teachers and hospitality workers. The more unstable the talent pool, the less employers can count on adequate staffing and training that impact their business growth and results. Insurance technology companies like Majesco are currently helping insurers assess, underwrite, and manage the growing array of new risks.

How can insurers make themselves more valuable to SMBs that need them more than ever in a rapidly changing risk environment?

Understanding the realm of insurance opportunity in the SMB market

In Majesco’s recently released 2022 SMB report, A Rapidly Changing SMB Landscape: Growth Opportunities Grounded in Grit and Resilience, we see a number of areas where SMB insurance buyers are rethinking the role of insurance in the business mix. Many business owners are just now waking up to the importance and value of insurance. SMBs have been impacted by COVID and the economy, supply issues and talent shortages, as well as increasing environmental, societal and technology risks. Many have been pushed into changing their own business models to adapt to a changing market and, as such, their risk has likely changed.

Business operation is only one area of SMB change. Change isn’t just about running a business; it’s about the experiences businesses encounter as buyers. Majesco found that SMB buyer sentiment is in the midst of rapid change. Business owners and decision makers are shifting from a generation with “traditional” purchase sensibilities to a generation where convenience, ease and digital process are just as important … very similar to what we found in our consumer research.

Product and business needs and channel preferences and value-added services share a blended focus, so it is crucial that insurers consider all of them as they attempt to innovate.

Motivated to move

Insurers who think SMBs are a one-size-fits-all commodity market will struggle to grow, let alone retain their customers. While risks are often classified into various categories, businesses are unique based on their business model, growth plans, products and services, technology, climate, society, and other forces of change.

The pandemic raised the importance of insurance in the minds of business owners, as reflected in Figure 1. This offers a unique opportunity to tap into this mindset and offer insurance solutions that will meet their changing needs and expectations. Simply offering the same is not enough.

Figure 1: COVID’s impact on the importance of insurance

Insurers must vary commercial insurance channels for purchase and engagement

Majesco research assessed the channel, products and value-added services desired and expected by SMBs. Insurers can use this information to test and develop new products and services that will best support SMBs with their existing business.

Commercial P&C represents about half of all P&C premium in the U.S. market. BOP, commercial auto, general liability, property, cyber, and workers compensation are key products for SMBs depending on their specific business model. SMBs need new or different combinations of coverages based on changes in their business models due to the pandemic. Insurers now have the opportunity to re-engage with them through expanding distribution channels or by developing new solutions to meet their new risk needs. From offering new products and services to using new distribution channels, to moving to a digitally enabled business, SMBs’ risk profiles have likely dramatically changed during the last 2 years, requiring a relook at their business risk and insurance needs. Just renewing current coverages is not sufficient to meet their needs.

Today’s insurance purchase process is still difficult. It lacks transparency. It can be complex and often time-consuming. In contrast, many insurance technology companies and new insurer innovations are refocusing to a “buying” over “selling” approach – through a multi-channel strategy that meets customers where and when they want to buy.

Commercial Auto Purchase Channels

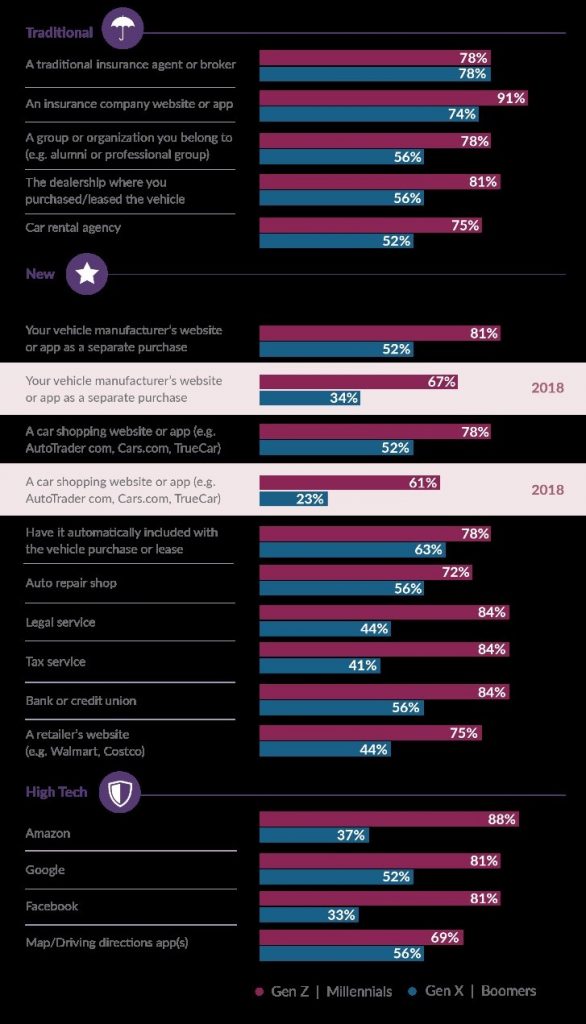

Traditional channels, including an insurer website/app and agents, continue as the overwhelmingly preferred channels for purchasing Commercial Auto for both generational segments. (See Figure 2) However, there are differences by generation for other traditional purchase channels including car dealership, car rental agency or other partnership organisations. The younger generations prefer a broader array of channels by 25%.

This trend continues for the “new” channels and significantly widens for the “high tech” channels. With the exception of including insurance with a purchase/lease and through an auto repair shop, the generational differences are 26% – 43% across all other options including banks, retailers, legal services, tax services and vehicle manufacturer or shopping sites. For “high tech” purchase channels, the gap is massive, at up to 51%.

Consistently, the Gen Z & Millennial segment is broadly open to an expanding array of channels. These trends point to key generational differences. The younger generational groups:

- Seek ease of purchasing insurance within other relationships that make it convenient.

- Trust different types of companies, which drives interest in non-traditional purchase options, such as high-tech companies.

Insurers need to grow their channel and partnership options with other entities to meet customers where and when they want to purchase insurance. Using only traditional agent / insurer website channels no longer works. It will look like an increasingly outdated strategy as Millennial and Gen Z buyers rapidly become the dominant owners and decision-makers. Even more importantly, the lack of establishing partnerships now will keep insurers out of the game and limit their market reach as partnerships become established by other competitors.

Figure 2: Interest in commercial auto purchase channels

Commercial Auto Engagement Channels

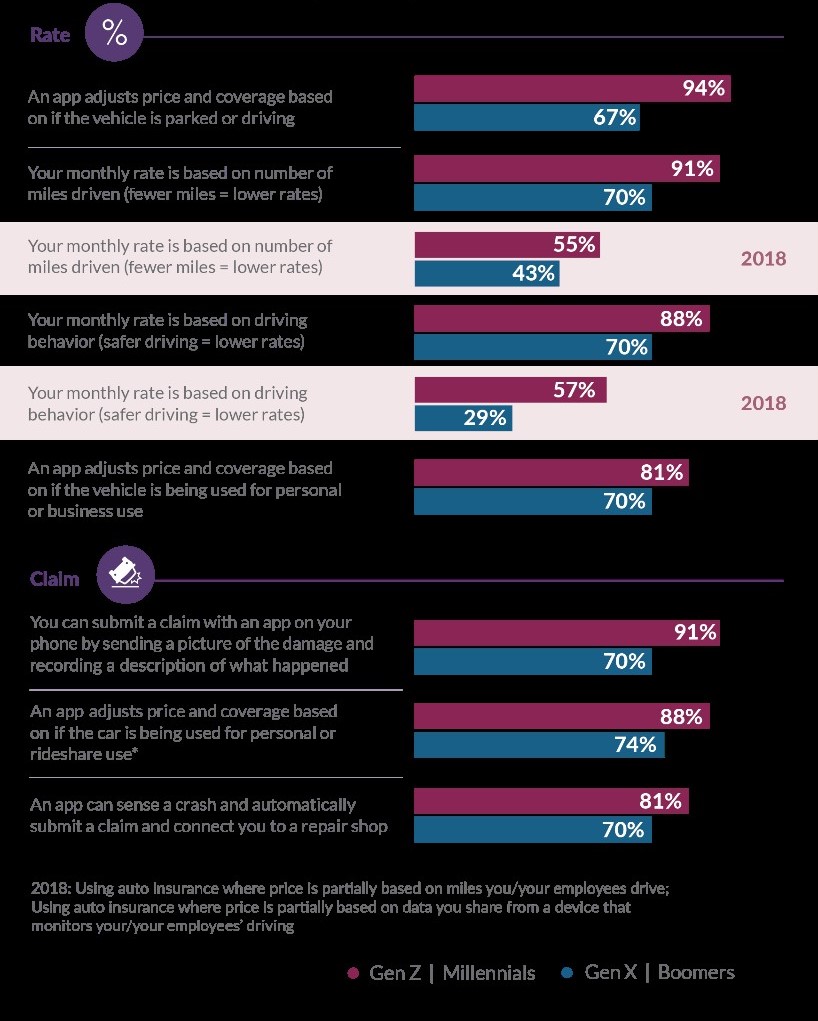

Both generational segments have similar interest in a wide range of commercial auto pricing and claims options, but gaps in the interest for some categories climb to 27% (see Figure 3).

Variable pricing continues to gain strong interest across a number of different options. The strongest interest was adjusting price and coverage based on whether the car is being driven or parked. The great majority (94%) of the younger generation is interested in this approach. The older generation also has a great deal of interest (67%). Both generations express interest in adjusting their pricing based on personal versus business use. Both generations show a remarkable increase in interest in rates based on miles driven, and in rates based on driving behaviour, compared to Majesco research from 2018.

For claims, both generational groups reflect very strong interest across all the digital app-assisted claims processes, from 70% – 91%. The nuanced difference for Gen X / Boomers reflects a desire for a process where they are in control. In contrast, the younger generation is very interested in parametric or automated claims processes which once again tie to their desire for digital, real-time convenience.

Figure 3: Interest in ways to use/activate and determine the cost of commercial auto insurance

Once again, this shows how insurance technology companies play a role in insurance marketing. Insurers who are not rapidly advancing in new pricing, management and engagement capabilities will fall well behind others who are leading the industry and capturing the growing demand and market share.

Commercial Auto Value-Added Services

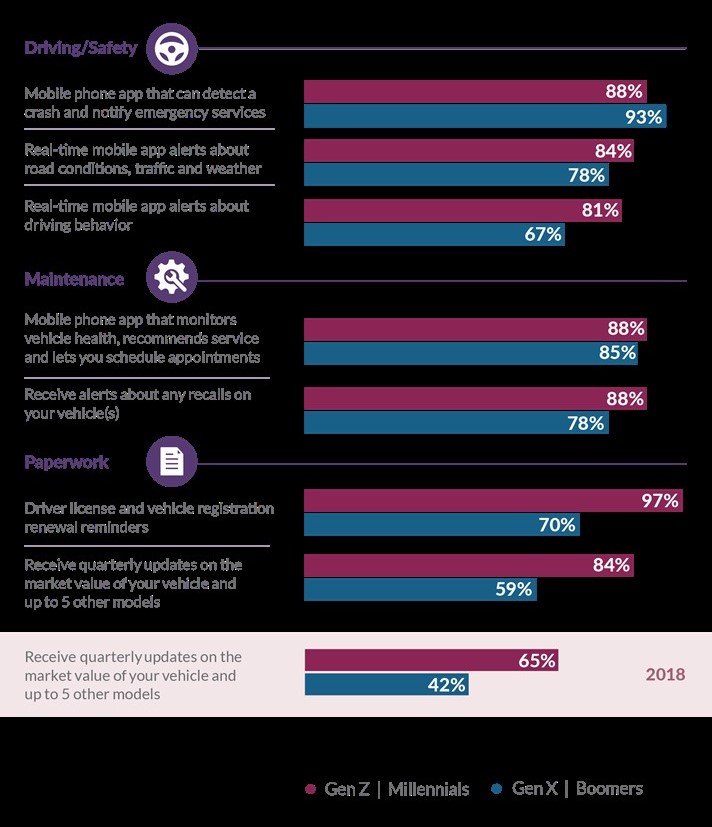

Value-added services represent “low hanging fruit” that can strengthen the value proposition and loyalty of customers. They are increasingly valuable to enhancing SMB stability and ease within business. (See Figure 4.)

Both generational segments are keenly interested in services that provide real-time information on driving/safety, maintenance, and paperwork related to their vehicles (59%-97%). This is an effective method for managing the safety of an employee pool with high turnover. Interestingly, the market value notification service showed strong increases over 2018 for both generational segments (19% for the younger and 17% for the older). Given the increased costs for both new and used vehicles and the limited inventory, these vehicles are increasingly viewed as critical assets on SMB balance sheets.

Figure 4: Interest in value-added services for commercial auto insurance

These results reflect a significant opportunity for insurers to shift the value discussion from just pricing to include a range of value-added services that could drive loyalty and retention for relatively little cost. Furthermore, it reinforces a relationship that helps customers reduce or eliminate their risk, helping to drive lower rates in the future.

Commercial Property/BOP Purchase Channels

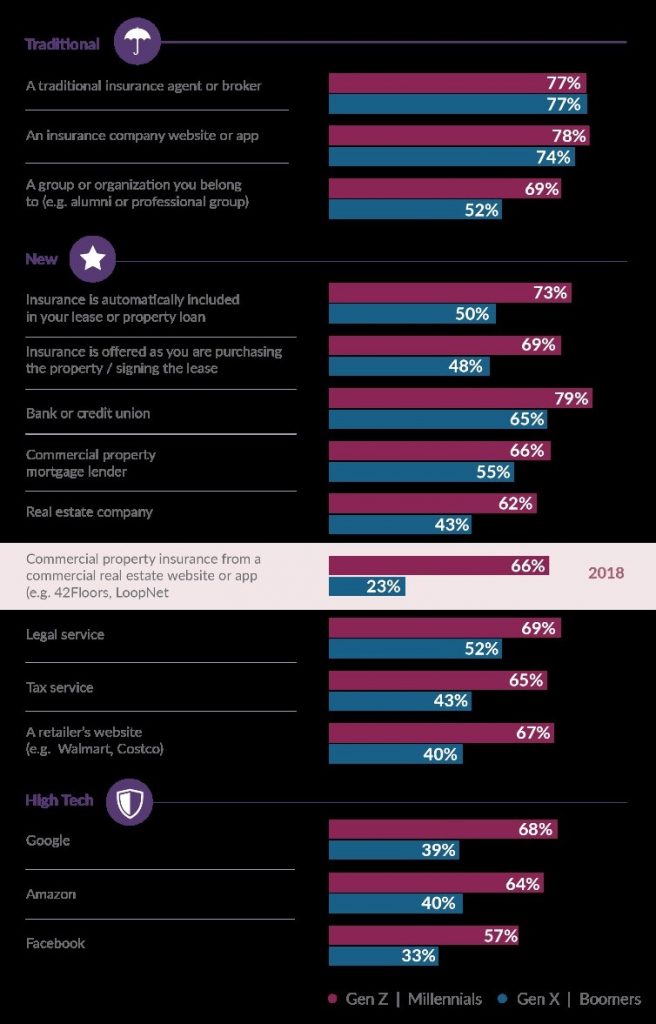

Both generational segments strongly agree that traditional channels including agents and insurance company website are of top interest. Purchasing through an organization is also of high interest for the younger generation, but less so for the older generation. (See Figure 5.)

The new generation of SMB customers, however, are increasingly interested in other channels to purchase insurance, based on trust and loyalty as well as ease of purchase. They are willing to purchase through a real estate company, legal service, tax service, retailer’s website, Amazon, or Google. This move away from the traditional siloed channels to those that offer or embed it at the time of purchase highlights the need for insurers to re-evaluate their channel strategy and expand their reach through new partnerships and relationships to meet customers on their terms.

There is a hurdle, however. Commercial property insurers understand that the traditional channels are far more effective for information gathering and that the initial collection of property data is the most crucial component to protecting against risk. Even if buyers wish to use new channels (such as at the point of a loan) insurers may not find themselves capable to create a new process that will more easily underwrite the risk.

Majesco is helping P&C insurers surmount this hurdle to gather and analyse property data in far simpler and digital ways, including digital self-survey or video, with our Majesco Loss Control solution. Utilizing this data and the most complete P&C database and Majesco data and analytics, Majesco Property Intelligence gives insurers a far more reliable and quick methodology for acquiring data and automating decisions using artificial intelligence — and it is embedded with our Majesco Policy for P&C for underwriting the risk. This is just one way that insurance technology companies such as Majesco are able to connect insurers to the needs and desires of the new commercial buyer.

Figure 5: Interest in commercial property/BOP insurance purchase channels

Commercial Property Value-Added Services

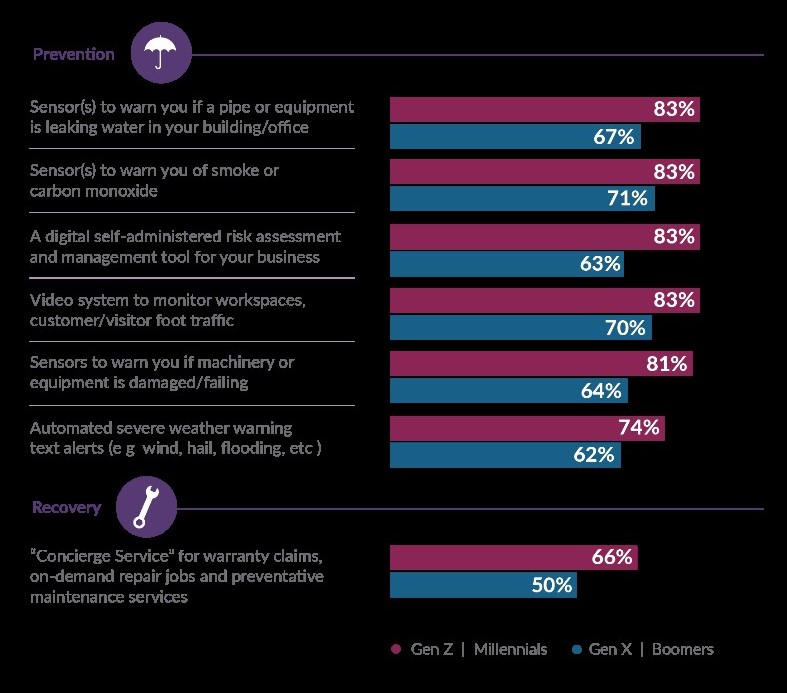

Value-added services that help manage prevention of and recovery from perils show strong interest to both generational segments, with Gen Z / Millennials consistently outpacing Gen X / Boomers by 15%. (See Figure 6.)

Both generations are strongly interested (62%-83%) in sensors and alerts for preventing or mitigating losses from fires, carbon monoxide, water leaks, machinery/equipment damage or severe weather, as well as video monitoring and a self-administered risk assessment tool. Concierge services, while slightly lower, still have significant interest of 50% to 66% for both generations. Gen Z and Millennials’ interest reflects a generational shift, where they seek services to help them manage and make their personal and business lives easier.

Figure 6: Interest in value-added services for commercial property/BOP insurance

The insights and impact of Majesco’s research highlight a renewed understanding of what it means to be a P&C insurer in a new age of risk. Insurers who think beyond the core risk product and personalize the underwriting and customer experience will have more success in capturing the business of Gen Z / Millennials as they increasingly become business owners and leaders, while at the same time keeping the business of their older, established customers. Value-added services that help customers manage and run their businesses as well as reduce or eliminate risk are a valuable tool for maintaining loyalty. And meeting SMB customers where and when they want to buy insurance through an increasing array of channels is crucial to retain and grow the business. If insurers use this knowledge to grow and cultivate business, they will find likely find that they have improved their ability to manage and reduce risk along the way.

Are you ready to meet the new insurance buyers’ needs with expanded capabilities? To find out more about SMB preferences and trends, be sure to read A Rapidly Changing SMB Landscape: Growth Opportunities Grounded in Grit and Resilience.

Denise Garth | Chief Strategy Officer | Majesco

Read more article from Modern Insurance Magazine here

Footnotes

- Cates, Lindsay and Richard Hartnett, Businesses Struggle to Find and Keep Workers Amid Record-High Job Openings, U.S. Chamber of Commerce, September 2, 2021.