Why would any claims department ever want to be the ‘best’ in the industry? When the ‘best’ is usually being described in terms of some confused definition of ‘service’ delivered to a tiny minority of policyholders.

Why would an outsource partner continually emphasise their ‘customer centric’ credentials, without actually defining and understanding exactly who their customers are, or what they really need?

Why is claims often described as the ‘moment of truth’ for the insurance sector when this very laudable concept means something entirely different to how it is being used, and elevating claims to this position of pre-eminence in the truth stakes is to severely distort the real position of the claims function?

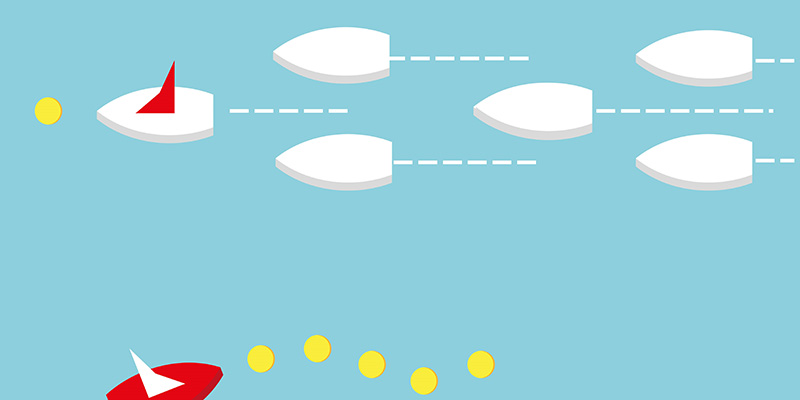

I ask these questions because it seems to me that the claims industry, where I ply my trade, is in danger of conforming to mainstream management theory about how businesses work when, in fact, very different criteria should be applied to our sector. Perhaps it is time to go ‘against the norm’ and develop our own definitions of excellence, relevance, and true functionality that would act as better reference points for strategic and tactical decisions in the sector.

It’s Not Our Function to ‘Settle Claims’

If Black & Decker sell 500,000 electric drills p.a., how many people want an electric drill?

The answer, of course, is none. Nobody wants an electric drill. What they want is a hole in which they can insert a screw and put up a shelf, hang a picture, repair a pipe, or a million other uses. The drill is an enabler and not an end in itself.

Exactly the same concept applies to the claims function. All too often I see claims departments operating with a focus on ‘settling claims’ and congratulating themselves on achieving ‘excellence’ as defined by customer ratings and NPS scores. Since when did customers become the sole arbiter of excellence?

If a claims department successfully and fairly triages liability decisions and settles fewer claims than previously, is that not also a description of excellence? Or maybe they become more adept at using appropriate loss adjusting services. Or perhaps they generate more income from fees, commissions and supplier contributions. You can bet that the finance department would regard this as ‘excellent’!

In other words, the function of claims settlement is as the enabler to achieving a more fundamental set of goals within the business. It is simply a means to an end and not the end itself.

It’s all About Value Creation

The core ‘raison d’etre’ of a claims operation is to find, design, and deliver value to the business. That value would be defined in terms of net cost management (i.e. fulfilment spend less income generated and subrogation), delivering the right customer solutions at the right time, protection of shareholder and policyholder interests, and a strategic direction that will enable the claims function to add to the competitive positioning of the business as a whole

If you get all of this right, and in balance, then you have cause to think that you have an ‘excellent’ claims function.

Going against the norm and redefining the claims function as the value creation department is not an act of rebellion. It is instead a reminder to us all that simply following the herd is the quickest way to I know to end up in the abattoir!