Insurance Quote Manipulation Flagged as Research Reveals Half of U.K. Consumers Think It’s Fine to Fib

LexisNexis Quote Intelligence – Manipulate Module – Launched at BIBA Conference 2022

Summary:

- LexisNexis® Quote Intelligence is a database that connects and compares thousands of motor insurance quotes from across the market.

- Its Manipulate Module helps motor insurance providers identify if information such as vehicle modifications or where the car is parked overnight, has been changed across online quotes.

- This insight can then be used as an additional risk factor at new business to support fair and accurate pricing, as well as ensure insurance providers can provide the right product for the consumer needs.

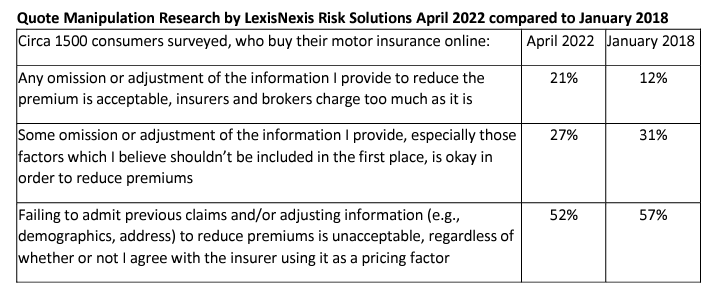

In a study of 1,500 U.K. motor insurance buyers in April 20221, 21% confirmed they think it is completely acceptable to manipulate the information they provide for a cheaper motor quote. This is a big jump from 12% in the same LexisNexis Risk Solutions study in 20182. Overall, 48% think it is completely or somewhat acceptable to deliberately misstate information to obtain a lower quote.

Responding to a growing concern that motor insurance coverage and pricing accuracy are being affected by consumers deliberately misstating key facts as they shop online for insurance, LexisNexis® Risk Solutions, the data, analytics and technology provider to the insurance market, can now help confirm the probability of quote manipulation at the point of quote.

LexisNexis® Quote Intelligence, a solution that connects and compares thousands of motor insurance quotes from across the market, now offers an enhanced Manipulate Module to help motor insurance providers identify if information, such as vehicle modifications or where the car is parked overnight, has been changed across online quotes. This insight can then be used as an additional risk factor at new business to support fair and accurate pricing, as well as ensuring insurance providers can provide the right product for the consumer’s needs.

By uncovering changes between quotes in key fields prone to manipulation, such as how many years the vehicle has been owned, years of licence held, occupation, and estimated annual mileage, LexisNexis Quote Intelligence can help protect insurance providers from inaccurate pricing and potential fraud.

These insights could also help insurance providers protect consumers from their policies being rendered null and void if deliberate misstatements are uncovered at the claims stage.

Uniquely, LexisNexis Quote Intelligence uses quote history data from across the motor insurance market so that insurance providers have a holistic view of quote behaviour.

Martyn Mathews, Senior Director of Personal and Commercial Lines at LexisNexis Risk Solutions Insurance U.K. and Ireland, says:

Many key fields in the quote process are prone to manipulation, and we now know that consumer willingness to manipulate quotes is high. Even before the current cost of living challenge, our research found that two out of five motor insurance customers think it is acceptable3 to manipulate the information they provide when obtaining a quote from a price comparison site.

LexisNexis Quote Intelligence provides real-time data insights to help identify potentially fraudulent behaviour for improved risk assessment and pricing accuracy at point of quote. This is all with the aim of treating the consumer base fairly, using a market-wide quote history database. We are delighted to launch the new manipulate solution at the BIBA Conference 2022. It offers an exceptional opportunity to show the real tangible benefits of industry collaboration on data-sharing initiatives such as this, as befits the theme of the event this year.

About LexisNexis® Quote Intelligence

LexisNexis Quote Intelligence helps insurance providers to improve loss ratios, avoid potentially fraudulent policies and make operational efficiencies, by combining an individual’s real-time quote behaviour and history in order to price more accurately. Quote Intelligence consists of three different modules: Connect, Tempo and Manipulate. Each module offers insights into both the main and named drivers on a quote, showing how different types of behaviours can be indicators of an individual’s risk. All modules can be injected at the point of quote through the LexisNexis® Informed Quotes platform.

Key Facts about Application Fraud in Insurance

- ABI Data shows the value of Application Fraud more than doubled in 2020, however, this was dwarfed by the suspected value of application fraud at £877,035 recorded in 20204.

- The average fraudulent insurance claim rose to £12,000 in 2020.5

- Application fraud rose 200% in 2019.6

Content provided by LexisNexis Risk Solutions

Read more article from Modern Insurance Magazine here

Footnotes

- LexisNexis Risk Solutions was not identified as the sponsor of this research, which was based on a survey of 1,546 consumers who had bought motor insurance online within the last 12 months and was conducted during April 2022.

- https://risk.lexisnexis.co.uk/insights-resources/white-paper/white-lies-and-misbehaviour-report LexisNexis Risk Solutions was not identified as the sponsor of this research, which was based on a survey of 1,500 consumers who had bought motor insurance within the last 12 months and was conducted during January 2018.

- LexisNexis Risk Solutions was not identified as the sponsor of this research, which was based on a survey of 1,500 consumers who had bought motor insurance within the last 12 months and was conducted during January 2018.

- Source: ABI.

- https://www.abi.org.uk/news/news-articles/2021/10/detected-fraud-2020/.

- https://www.abi.org.uk/news/news-articles/2020/09/detected-insurance-fraud/.