Over the past few years, fire-related insurance claims have grown significantly. James Mountain, sales and marketing director, Fire Shield Systems, discusses the various factors influencing fire risk, and explores how insurers can strengthen policies to maximise safety and minimise claims.

Different risks for different environments

Commercial insurance policies need to consider how fire risks can vary across different industries and environments to minimise site risk.

While the need for fire protection and suppression is widely recognised for building cover, all to often, policies will simply state the need for an ‘approved’ system to protect high-risk sites. This can create ambiguity, where business owners can select the cheapest approved system, which may not effectively address their unique fire risks. For example, by selecting a sprinkler system that will work to protect a warehouse shell, instead of the valuable vehicles and machinery inside that’s vital for business continuity.

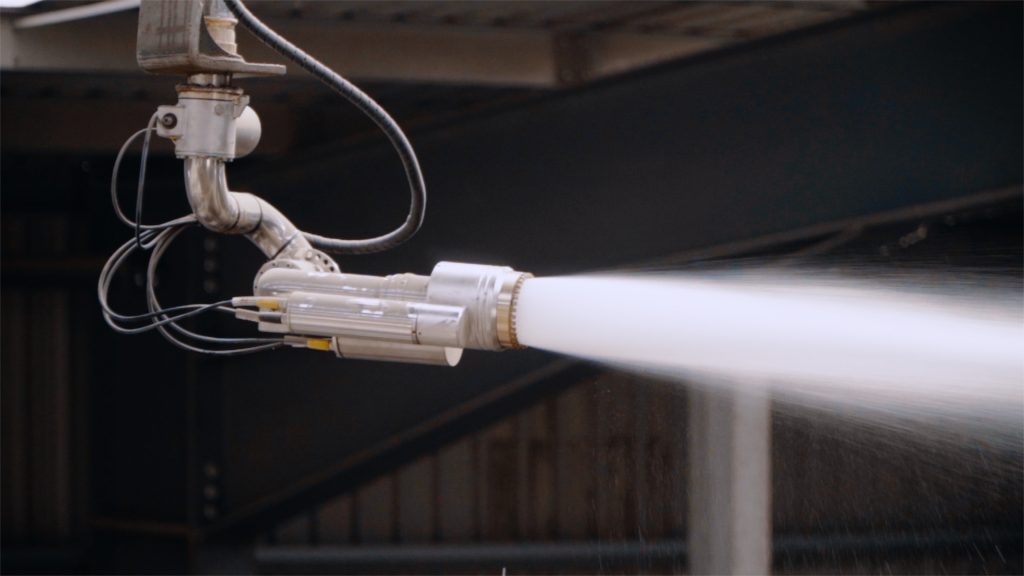

Insurance policies should only be approved when fire protection and suppression systems meet the individual site risk requirements. For example, in process industries, this means approving vehicles and machinery protection systems that are specifically designed to endure 24/7 operation and harsh operating conditions, instead of a manufacture-standard system installed during production to account for ‘typical vehicle use’.

For many high-risk sites, there’s currently no industry requirements for protection systems to comply with particular standards or specifications. This makes finetuning insurance policies for individual site risks critical, which requires a deep understanding of the risks arising from the site’s everyday operations. That starts with a highly-detailed risk assessment.

What’s influencing the risks?

- Focus on sustainability

The UK’s drive for sustainability is resulting in an increased reliance on sustainable entry storage and battery power, which is seeing a rise in the amount of li-ion batteries present on commercial sites. As traditional systems aren’t as effective in controlling battery fire risks, they require a unique protection solution. This should be outlined in insurance policies protecting against battery fire risk, such as those for sustainable fleets or underground carparks. - Materials stockpiling

As a result of Brexit’s impact on international trade, alongside the Basel Convention Regulations and the ongoing impact of China’s ban on solid waste, prolonged material stockpiles are becoming extremely common for industries like ports and docks and waste and recycling. This is creating significant capacity issues, which increase the sites’ reliance on detection and suppression systems to ensure safety. This makes it all the more critical for these insured systems to be able to withstand the operating environment and address its individual risks. - Seasonal temperature highs

As the UK continues to record hotter and drier temperatures, indoor and outdoor fire risk is also increasing, particularly over summer months. In higher temperatures, combustible materials are often much drier and susceptible to excess heating after being exposed to direct sunlight for prolonged periods. When stored in stockpiles, these materials can form deep hotspots, which can be challenging to identify for traditional detection systems. Increased wind can also spread these hotspots, making suppression more difficult. To counter these risks, insurance policies need to ensure outdoor protection measures are able to operate effectively throughout more extreme weather conditions.

Insuring against the rising risks

Although risks can vary widely between sites, there are some common things to consider that can help to strengthen fire safety through insurance underwriting.

- Highly-detailed risk assessment – recognising and identifying site, industry and operation-specific risks.

- Detecting risks – how will the detection system work in the specific application? Different systems will suit different environments.

- System activation – will the system be automatically or manually activated? If manually, how will the system notify the operator, and will someone always be on site to monitor this? Is the system appropriate for the assets being protected?

While insurance claims for fire-related incidents continue to rise, ensuring systems are only approved if they match a site’s unique risks and operating environment is critical.

To find out more, visit Fire Shield Systems or call 0800 975 5767.

Read more article from Modern Insurance Magazine here