Average auto use is only 4% of each day, yet a new vehicle purchase frequently costs 50% of someone’s annual income.[i] When you add in taxes, fuel, insurance, and maintenance, many people can’t make a logical case for ownership. This is especially true in urban areas, where mobility options are plentiful and on the rise. In spite of these facts, auto ownership is also on the rise. If we look at the complete mobility picture, auto insurance will remain relevant while at the same time non-traditional transportation insurance is going to begin to grow, particularly as people continue to use their vehicles to earn extra money via ride-sharing companies. This creates a need for “hybrid” P&C mobility products.

E-bikes, for example, are a rapidly-growing mobility option for those who wish to purchase a less expensive way to commute. They are also available through massive bike-share networks, such as Chicago’s Divvy system of bikes and e-bikes.

E-bikes aren’t the only mobility option that is on track for growth, but they make a good case in point. They check the boxes for trends that could disrupt auto use and auto insurance. They are highly economical. They are faster than traditional bikes (approximately 21% faster per trip).[ii] If you’re using them for a commute, you’re less likely to arrive at work exhausted and sweaty. They are easy on the environment. They give you some freedom to go where you wish to go without sticking to a public transit route. Shipping companies, such as UPS, are even considering e-bikes for last-mile delivery.

E-bikes have even been shown to encourage people to ride more, and since e-bikes use pedal-assist technology, the net effect could be that e-bike users improve their health.

Of course, there is a flip side to e-bikes that involves insurance. Due to their potential speed (20 mph), they are less safe than a traditional bike. Their components cost more to replace in an accident claim. Their riders may have less two-wheel experience because E-bikes are appealing to some riders that would not normally ride a traditional bike due to age, health, or hilly terrain.

Even though e-bikes aren’t going to displace vehicles anytime soon, P&C insurers need to grasp their potential impact, along with the impact of car-sharing, ridesharing, transit improvements, work-from-home lifestyles, and the use of personal vehicles for business use. Mobility is changing and insurance will need to shift to capture the opportunities it will create.

For several years now, Majesco has been tracking and understanding how we move.

In our previous Mobility research, we noted the significant change in automotive activity is resulting in companies outside insurance coalescing around a shift to the concept of “mobility.” From the decline in car ownership for the first time since 1960, to the rise of ride-hailing and car-sharing services, a plethora of transportation options continues to expand – hence the focus on mobility. In this year’s Consumer Research report, Majesco looked at the consumer trends with the greatest impact on P&C insurers. You can dig deeper into these shifts by reading Your Insurance Customers: A Crystal Ball of Big Changes in a Small Window of Time. Today, we’re making a case for mobility. Does your organization grasp how the coming mobility shift requires insurers to rethink products and services that fit these new risks?

Mobility in motion

Let’s look at where mobility is today. According to the American Time Use Survey, the percentage of people travelling in 2020 dropped by 17 percentage points, to 67% from 84% in 2019[iii] – likely driven by the remote work environment.

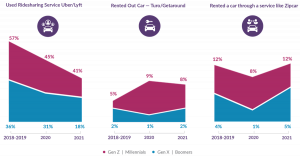

The use of rideshare services like Uber and Lyft dropped when COVID hit in 2020 and continued to decline, especially among Gen X & Boomers. Gen Z & Millennials continue to value mobility as they use new mobility options like e-bikes, scooters or short-term rental of cars from a service like Zipcar, or another person’s car through a platform like Turo or Getaround.

Figure 1: Mobility activity trends

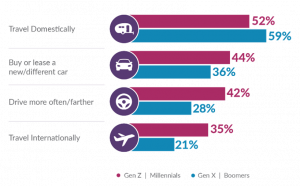

However, the automobile is still important to Gen Z & Millennials. They bought and/or sold a vehicle at over twice the rate of Gen X & Boomers, with 42% indicating they bought or leased a car, 21% sold a car, and 28% either added a car or bought their first car.

Figure 2: Mobility activities in the past year

In the next three years, automobiles should see a resurgence. Gen Z & Millennials in particular will be buying/leasing new vehicles and expect to be driving more than they currently do. This suggests two key potential shifts in auto insurance:

- First, the popular UBI-based insurance, which has seen growth due to COVID and remote work, may need to be adapted beyond just miles driven, to consider where and how to manage customer value and cost expectations.

- Second, the surge in buying new vehicles that have embedded, sophisticated technologies for telematics, sensors, and driverless functions, as well as innovative services, will likely create demand for embedded insurance in the purchase from the manufacturer. Increasingly, auto manufacturers either offer or are soon to offer embedded insurance. This shift requires insurers to offer similar coverages and services to retain customers, or to partner with automobile manufacturers.

Regardless, the growth in new, technically sophisticated vehicles will require insurers to move beyond both traditional auto and UBI insurance products to new options that reflect lifestyles and behaviors, and are inclusive of value-added services.

Furthermore, with the easing of COVID restrictions, the pent-up demand for travel, especially within the U.S., is expected to grow. This offers a market opportunity to provide on-demand coverage for specific events, trips, mobility options, and bundled packages, such as American Family’s Road Trip Accident Accommodations Coverage. Furthermore, the rise of travel via planes and the challenges with airlines has seen an increase in demand for travel insurance.

Figure 3: Mobility expectations in the next 3 years

How will customers buy the mobility insurance they need?

From a product perspective, customers expect an expanding array of products to meet their changing behaviours, needs, and expectations. The Gen Z & Millennial generation is vastly different than the older generation, both in terms of their lifestyle but also their digital savvy and life journey. However, both still want digital and multi-channel options as well as a growing array of value-added services.

This presents significant implications as well as opportunities for insurers, all based on how rapidly they plan and execute against them. Many InsurTech start-ups and incumbent insurer greenfields are specifically targeting the Gen Z & Millennial generation with new, innovative products, value-added services, and experiences that are vastly different than most traditional insurers.

Majesco analyzed consumer data against insurer data from a joint research project with PIMA in 2020 for program business and affinity plans for three insurance segments (Life/Heath/Accident, Auto, and Home/Renter). You can see more on Life/Health/Accident and Home/Renter by downloading the Consumer Research report. Our analysis was aimed at figuring out if insurers are aligned to customer sentiment regarding how they would like to buy auto/mobility insurance.

Product and Channel Alignment

The prime opportunities lie in areas where there is high customer interest in a particular insurance channel, and insurers are ready to move into that channel. That is represented in the top right quadrant in figure 4. However, the greatest breadth of opportunity lies in areas where customers are ready to purchase through a particular channel, but insurers aren’t prepared to utilize that channel. That is represented by the top left quadrant in figure 4.

Figure 4: Auto insurance channel alignment/misalignment

Customer Experience

There is also considerable insurer-customer misalignment in the customer experience. Both generation segments use websites at similar levels for managing insurance, finance, and lifestyle products and services. However, insurance falls woefully behind in giving customers the ability to manage their products and services with mobile apps. This is especially concerning with Gen Z & Millennials, whose use of apps is 21 and 31 percentage points higher for finance and lifestyle products and services, respectively. These are gaps that must be closed by insurers.

[i] 2018 Evolution of Mobility Study, 2019, Cox Automotive and Mobility

[ii] Bernsten, Sveinung, Lena Maines, Aleksander Langaker, Elling Bere, Physical activity when riding and electric assisted bicycle, International Journal of Behavioral Nutrition and Physical Activity, April 26, 2017.

[iii] “American Time Use Survey Summary,” op. cit.